participant.pncbenefitplus.com – How To Access PNC HSA Login

Login to PNC Health Savings Account

Put something aside for qualified clinical costs on an assessment advantaged premise. Allow your cash to develop so you can all the more effectively manage the budget of your deductible when required. From charge, profit, advantaged commitments, and withdrawals for qualified clinical expenses. You own the record and the cash in the personal account, regardless of whether your boss adds to it. Assets turn over from year-to-year if unused.

The equalization in your HSA may develop tax-exempt with no strain to utilize the full parity by year-end. You might have the option to use unused adjusts to enhance retirement salary after age 65, subject to annual duties. Your cash remains with you regardless of whether you switch employments, change clinical inclusion, become jobless, or resign.

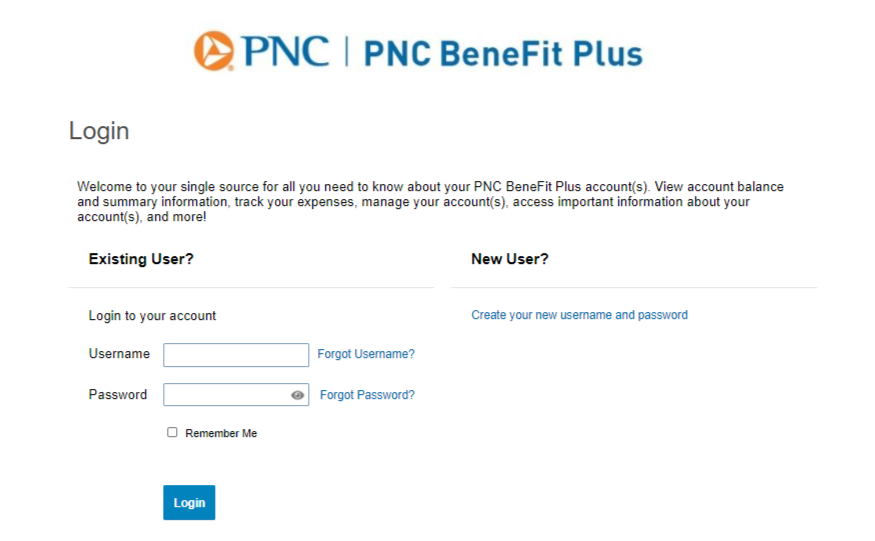

PNC HSA Login:

- To login open the website, participant.pncbenefitplus.com/

- After the page opens at the center provide the login information, and click on, ‘Login’ button.

- If you want to recover the username of PNC benefits, enter your account or email, and your name, click on, ‘Next’ button.

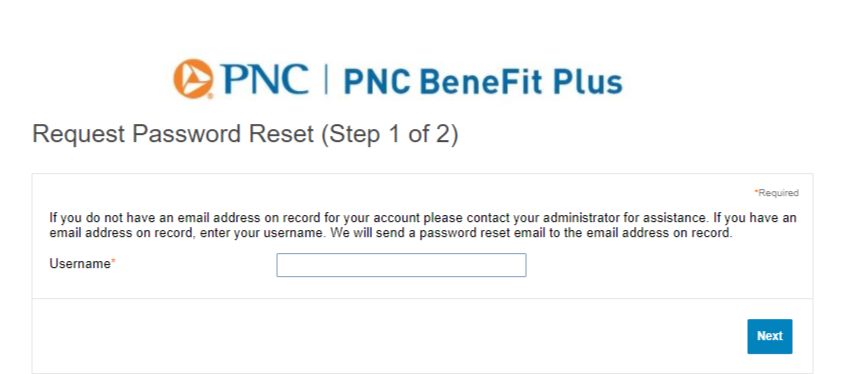

How To Reset Password :

- For forgotten password, enter the username, click on, ‘Next’ button.

- If you want to create a new user account, tap on, ‘Create a new username or password’ button.

- On the next screen provide your personal details and hit on, ‘Next’ button.

Frequently asked questions on PNC HSA

-

Definition of HSA and who can have one?

A Health Savings Account is an assessment advantaged account set up to pay for qualified clinical costs for those who applied for HDHP. It’s the most described by higher deductibles and lower monthly premiums. With cash from the account, make payment for medicinal services costs until you meet the deduction.

-

How would I know whether my HDHP is an HSA-qualified arrangement?

An HSA-qualified wellbeing plan is required to fulfill necessities concerning deductibles and cash-based costs.

-

Would I be able to join up with both an HSA and a Health Flexible Spending Account?

If you join up with or secured by a broadly useful FSA or Health Reimbursement Arrangement that pays or repay for qualified clinical costs, you can’t take a crack at or make commitments to a Health Savings Account for that inclusion period. In any case, you might have the option to make commitments to an HSA if you are secured under a constrained reason FSA or HRA. FSAs and HRAs limit repayments to certain allowed advantages, for example, vision, dental, and preventive consideration benefits.

-

Does the HDHP need to be in my name to open an HSA?

No, the HDHP doesn’t need to be in your name. You can be qualified for a Health Savings Account as long as you have an inclusion under an HDHP, expecting you to meet the other qualification necessities for adding to a Health Savings Account. You can be qualified regardless of whether the HDHP is in your life partner’s name.

-

If I try out an HSA mid-year, HDHP, and what is the suitable commitment sum?

Most recent month rule, on the off chance that you have benefits inclusion on the day of the most recent month of your duty year, you are viewed as a qualified individual for the whole year. The yearly Health Savings Account commitment made for that fiscal year.

-

Does the HDHP need to be in my name to open an HSA

No, the HDHP doesn’t need to be in your name. You can be qualified for an HSA as long as you have an inclusion under an HDHP, expecting you to meet the other qualification prerequisites for adding to a Health Savings Account. You can be qualified for an HSA regardless of whether the HDHP is in your life partner’s name.

-

Is there a cutoff time for commitments to an HSA in a duty year?

For a built-up Health Savings Account, commitments for the duty year can be made in at least one installment whenever after the assessment year has started and before the person’s expense recording cutoff time.

Contact Help

To get more help call on, 844-356-9993.

Read More:

Reference link: